- A critique and flaw of Keynesian policies that are applied to fight a recession. (An expansionary policy!)

- The policy of cutting Taxes and raising Spending will create a budget deficit.

- The budget deficit must be funded and to do this Congress orders the sale of US bonds.

- (This is NOT a Monetary Policy tool used by the Fed)

Where does the money come from?

Where does the money come from?- US citizens and companies, investment firms, foreign countries

- Money that could be spent on Consumption or used for Private Savings is now being used to buy bonds.

- This will cause the Money Demand curve to shift outward. Remember this is a Fiscal event!

- This will cause the Supply curve to shift inward because we are not Saving money privately any more.

- This can cause the Demand curve to shift outward because the private and public demand for $ increases_.

- The nominal and real interest rate will increase.

- The increase in nominal and real interest rates will cause Ig to decrease.

- Fiscal Policy supporters (Keynesians) insist that gains in

- C and G will outweigh any loss in future Ig.

Why?

Why?- C and G are greater than Ig and they are Short Run improvements.

- Ig is longer run and Keynesians don’t worry about that.

- In the long run we are all dead.

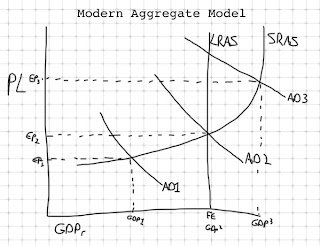

this is summarized on the Aggregate Model.

- The AD will move outward due to the increases in C and G

- then “maybe” move inward due to a loss of Ig,

- but not as much as the increase.

- Therefore the economy improves.